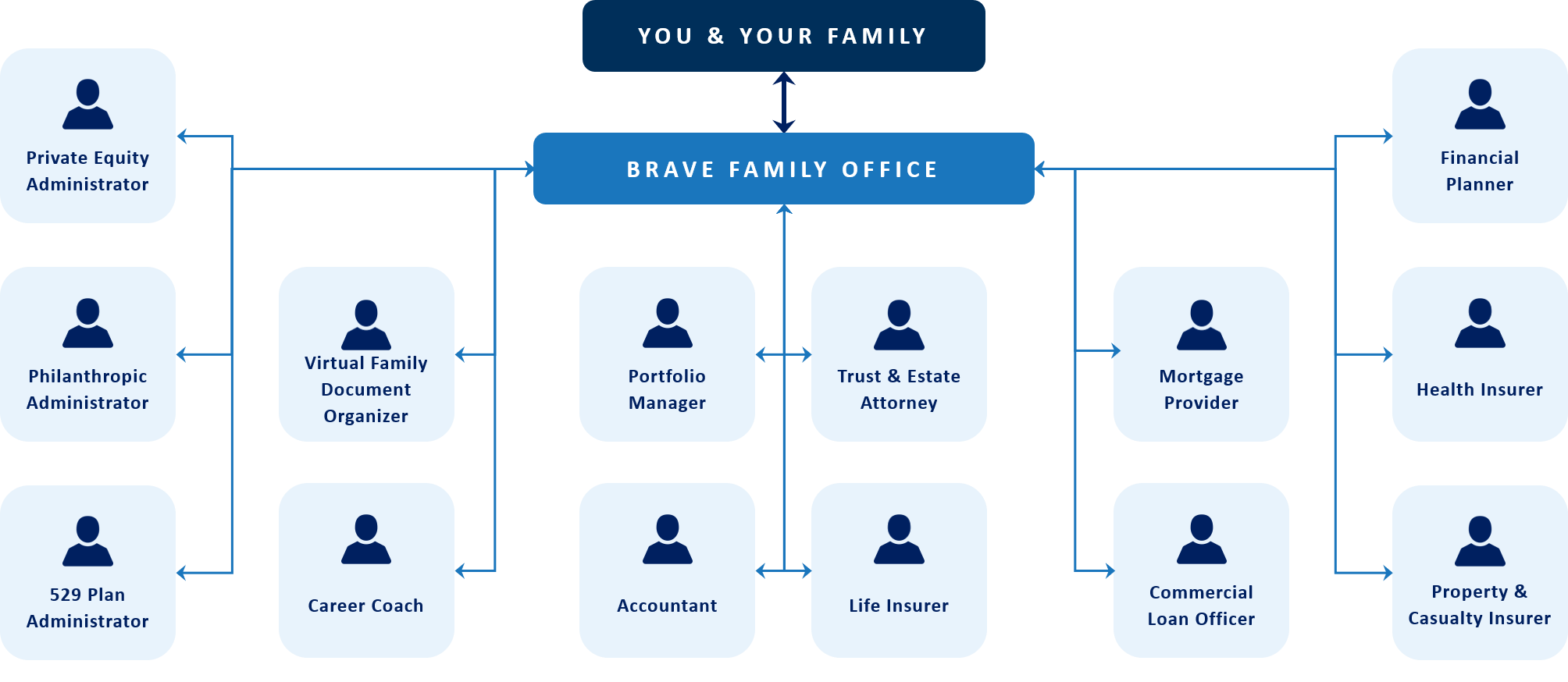

Wealth Management and Family Office Services

At BRAVE Family Advisors, we seek to serve our clients in ways that go beyond investing. Often times greater wealth can bring with it greater complexity. We seek to use our personal experience in dealing with our own families and those of our clients to help simplify some of those challenges. In some cases, we essentially function as a client’s financial quarterback or personal Chief Financial Officer providing a single point of contact for all financial matters. These can include both internally-provided services and those provided by third-parties which we help coordinate and manage. We do not receive any compensation from any outside service providers.

Areas in which we can help include:

Wealth Management

We provide comprehensive oversight and management of family wealth including portfolio management, assisting in evaluating outside managers of alternative investments, establishing 529 education savings accounts, and executing Rule 144 stock sale programs.

Financial Planning

We work with clients to develop a financial blueprint to ensure they are on a path to meet their financial goals in areas such as saving for higher education and retirement, structuring a charitable giving plan, achieving tax efficiency, and creating multi-generational security. We update the plan at least annually as life changes and markets go up and down.

Trust & Estate Planning

We work with outside attorneys to assist our clients in developing a comprehensive estate plan which can include wills, healthcare proxies, financial powers of attorney, and wealth protection and transfer strategies. We can collaborate with a new clients’ existing attorney or can provide an introduction to one in our network.

Tax Coordination

We track W-2 income, realized gains/losses, interest, dividends, private business income, and deductible expenses, which we provide to our clients’ accountants to facilitate estimated tax payments and annual tax return preparation. We can work with a client’s existing CPA or can provide an introduction to one in our network.

Insurance

We work with a network of insurance providers to ensure that our clients have the proper types and amounts of property, casualty, and life insurance at competitive rates. We do not accept any commissions or referral payments for any insurance that our clients buy.

Private Investments

Many of our clients have private equity and fund investments. We can organize relevant documentation, monitor those investments, track capital calls and distributions, and follow up on obtaining tax information.

Borrowing Needs

We coordinate and negotiate solutions for our clients’ residential and commercial financing needs with our network of preferred lenders.

Document Depository

We aid families in establishing and maintaining a central electronic archive for important documents.

Family Communications

We often play a leading role in facilitating education and communication for a family in areas such as financial management, governance, wealth transference, philanthropy, and career planning.

Career Assistance

We furnish coaching and guidance to help maximize current career potential and assist in transitioning to a new path mid-career or post-retirement.

Philanthropy

We help our clients plan their charitable giving. As an important part of that, we have relationships with community foundations and can assist in establishing donor advised funds.